As discussed in the previous article (http://bizliaison.jp/archives/371 ), you cannot have Flat 35 fully finance your housing with rentals. Flat 35 is only applicable to your residential area, and the rental part of the property needs to be financed by something else like bank loan. But banks in general give low valuation for a property mortgaged by Flat 35.

Housing with rentals may be financed by housing loan if requirements are met

For those who would like to have your investment to a housing with rentals leveraged, we would suggest discussion with some local banks which offer both housing loan and apartment loan. Finance approach differs among banks.

<Bank B Case>

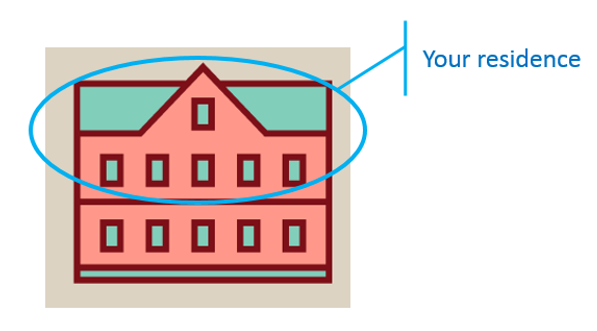

Pattern 1: Housing loan + Apartment loan

This pattern applies to the house where you occupy over 50% of the overall floor area and rent out the rest. In the case of the house above, you use the 2nd and 3rd floors for your own use and rent out the 1st floor. For bank finance, you can use housing loan for the 2nd and 3rd floors and apartment loan for the 1st floor. Please note you must talk to a bank who offers both housing loan and apartment loan. If two banks are involved, it is likely that you will have inconvenience in various aspects.

For the example above, of course, you can use apartment loan for the entire property. But I assume you would like to make the most of mortgage tax relief even if the tax cut is only applicable to part of your property.

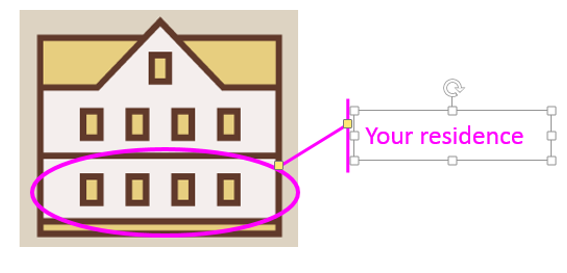

Pattern 2: Apartment loan for the entire property

In the case of the house above, your residence area is less than 50% of the property. You cannot apply for housing loan at all. Bank would offer you apartment loan for the entire property.

<Bank U Case>

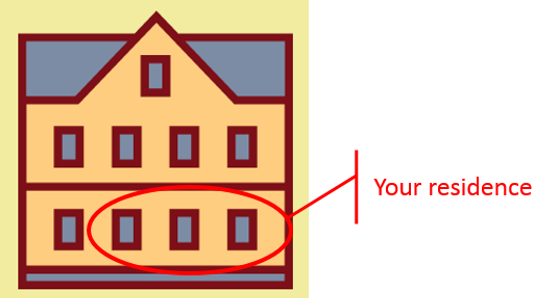

Housing loan can be used for overall property if over 30% is used for your residence.

The key requirement is that you use 30% or over of the property. The bank will fiance your entire property at their housing loan rate. Sounds exciting! Compared to Bank B’ Pattern 1, Bank U’s approach seems to be quite appealing. But you will have to check the rate Bank U offers. According to Bank U’s brochure, the rate ranges from 1.80% to 5.475% (as of March 2018). I assume most will tap bank finance at over 4% levels.

Good point about Bank U’s loan is that they are willing to finance even those who are turned down by other banks (e.g. no PR holders, self-employed, non-high-income person, etc. ). If you fail to pass preliminary reviews with multiple banks, Bank U may still serve as final resort.